Consider following on social media!

Quick note: if you’re viewing this via email, come to the site for better viewing. Enjoy!

Photo by Nicola Barts, please support by following @pexel.com

Here’s a situation, you are working on your small business and you’re thinking about growing your enterprise so you can further scale to make your company become the industry giant you have set your sights on.

However, you begin to notice that cash isn’t flowing like it once was. You begin to question: “Why? How did this happen? I know my company is turning a profit. What in the world is going on here?” You check your business account only to find your money has been going places it doesn’t need to be.

You find you don’t need this stress since you have other pressing things to worry about and trying to get your finances back on track doesn’t rank high on your to-do list. This situation would be better suited if you had access to a certain team of people with a particular set of skills (my second Taken reference sorry).

There’s a name for a group of people that handles the operation of financing, but I just can’t recall it.

Photo by Kuncheek, please support by following @pexel.com

Clouding Around

Do you want to cut costs and track your money in the meantime and all the while grow your business to new heights? How would one do this you might ask?

Well, you have two options which are 1) you could venture to handle everything yourself which in turn would be a complete and utter nightmare, seeing you go from 0 to 100 in 1.5 seconds flat due to the fact you got overwhelmed, or 2) find yourself a team of people who could manage and monitor, assess, and even advise your finances for you.

What group of people would be crazy enough to do such a thing? Financial Operations or FinOps for short. FinOps is a cultural practice that brings cloud technology and business altogether to drive accountability and maximize business value.

FinOps are governed by six principles: collaboration, ownership, centralized cost savings, reporting, value, and taking advantage of variable costs. If you’re looking to scale your business and moving to the cloud or growing your cloud is going to be on the menu, FinOps are going to be one group needed to make sure all resources are accounted for and the budget stays on track.

In a nutshell, you can think of them as accountants for your current or future cloud.

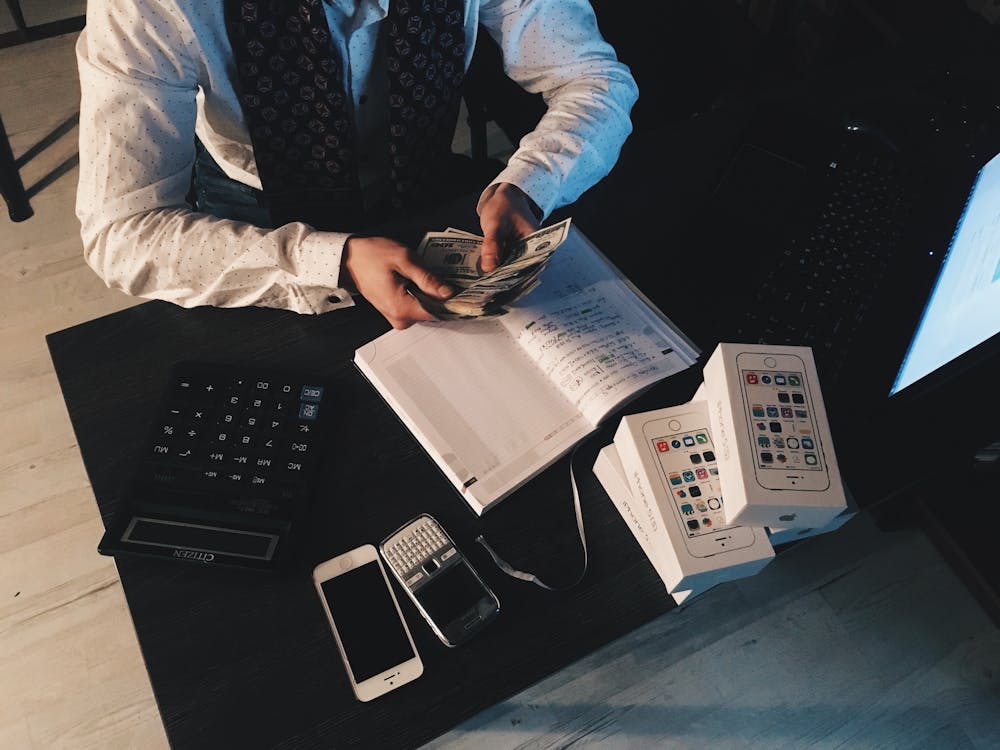

Photo by energepic, please support by following @pexel.com

Sales in Failure are Final

Oh dear reader of mine, you may be thinking to yourself, “Why would I hire an accountant? I manage my bank account and business account just fine. I budget well, I’ve got nothing to worry about.”

Well, as mentioned before, if you lack the skill set to operate in the cloud and begin to connect resources without a care in the world, your dollar sign will quickly get overwhelmed. Everything costs in the cloud down to the computing power which could range from a second to minutes.

So yeah, money management would get out of hand before you even completed computing “Hello World” using a Lambda function. Therefore, having a FinOps team would be very beneficial. What group of people would turn to FinOps for information?

Financial planners, analysts, business managers, and advisors use reports from FinOps for cost allocation and forecasting. This is like having a weatherman in your business, but they’re actually paid to get the forecast right.

Enjoy the read so far? Why don’t you consider subscribing so you can keep up to date?

Photo by fauxels, please support by following @pexel.com

Fins Cuts the Budget

How much does FinOps have a play in the world of today you might be wondering. Well, that depends on what part of the world you are in, if you’re the employer, you’re more likely to hear about how certain cloud resources are outside of your budget and how you should be focused on cutting costs.

If you’re the employee, then it’s more likely you’re hearing about how cloud resources you could use, and need are outside of the company’s budget and how much the company needs to focus on cutting costs.

FinOps has been around since 2012 and many companies both big and small have adopted the FinOps framework to run their business. This adoption helps edge out the competition by enabling companies using FinOps to be capable to make better data-driven decisions, reducing costs on wasted resources, creating investment opportunities, and increasing transparency.

Just think of them as all good things to have if you get hit with an audit. Again, this group has a particular set of skills that work in your favor, just don’t forget to pay them on time.

Photo by Andrea Piacquadio, please support by following @pexel.com

Choosing Paths

So, you may have the response “Nah, I can handle my budget and others with no problem. Just tell me, do I need a degree?” There’s some good but pricey news, you don’t need a degree to get into FinOps, just need to be familiar with their core principles.

FinOps is a cultural mindset developed to provide accountability to a business. Your time will be better suited to pursuing certifications with some specialized credentials like a Chartered Financial Analyst (CFA) or Certified Equity Professional (CEP) however, obtaining these certifications is not going to be easy, and knowing your stuff when it comes to financing is a must.

Another option is you could join the FinOps Foundation and select from their courses to become either a certified practitioner (I know I mentioned this step but skip becoming a practitioner, employers don’t recognize them) or hop right into becoming a certified professional. Just know, this is going to get pricey since this ranges from $599 – $3,750 (I did say I had some pricey good news).

But if you’re trying to learn on a budget, again Zero daddy has you covered. There are other resources, Coursera has one course on FinOps provided by Intel, and there are several courses on Udemy. Just stay away from getting caught up in tutorial hell. Gain a deep understanding of the basics, build upon them, and keep on moving.

After obtaining some of these credentials and online courses, you will be able to demonstrate your knowledge of investment and financial management best practices. Or you could do a combination if you have the time and money, it all boils down to what goals you have in place.

Photo by Markus Winkler, please support by following @pexel.com

Made it this far and found this to be entertaining? Then a big thanks to you and please show your support by cracking a like, scripting a comment, or plug-in to follow.

Would like to give sincere thanks to current followers and subscribers, your support and actions mean a lot and has a play in the creation of each script.

Think there something that might have been missed about Finops? Script a comment below.